Document Compliance

Why did I get a notice when the document was on the listing?

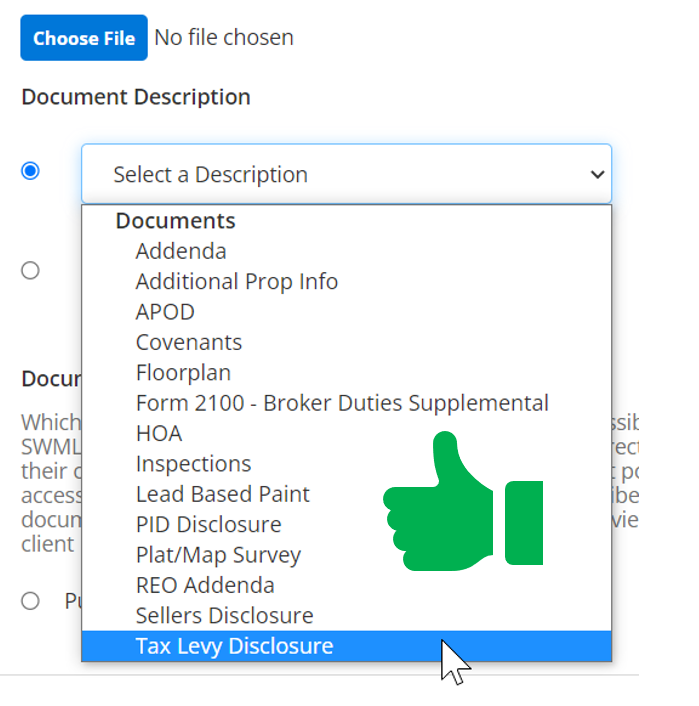

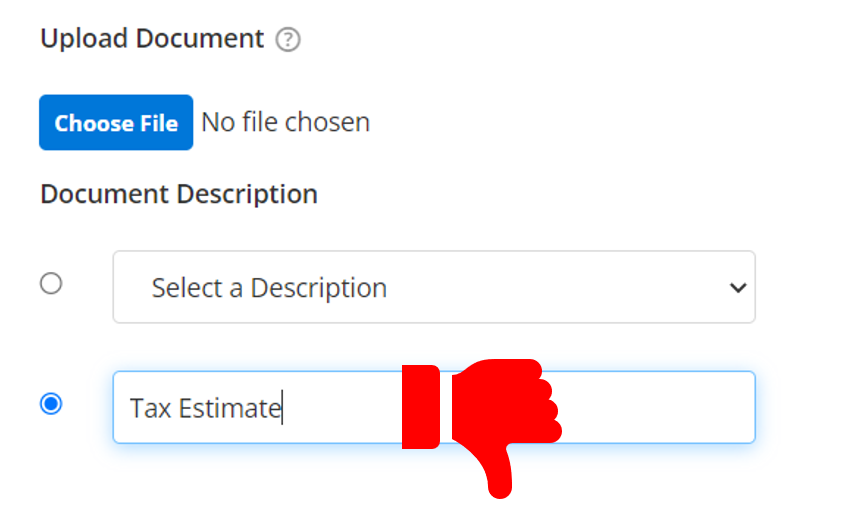

Our system detects the name of the document, and it must be an exact match in order to not flag. The best practice to make sure you are not flagging is to utilize the drop down menu descriptions instead of entering a custom description.

Tax Levy Disclosure Information

CLICK HERE to read NM Statute 47-13-4 related to the Tax Levy Disclsoure. Disclosure uploaded to the MLS must be the one provided by the county tax assessor and/or include at minimum (1) the actual amount of property tax levied for the current calendar year, (2) an estimated amount for the following year based on the current list price, and (3) the disclaimer outlined in the statute.

Click the link below and follow the instructions to obtain the County Assessor provide Tax Levy Disclosure.

- Bernalillo County Tax Assessor

- Search for Property > Tax Calculator (left side) > Enter List Price and click Calculate > Save the page as a PDF and upload to MLS

- Sandoval County Tax Assessor

- Click Enter EagleWeb > Search for Property > Click on Property > Click Estimate Taxes (left side) > Enter List Price and click Print Tax Estimate > Save as PDF and upload to MLS

- Santa Fe County Tax Assessor

- Enter Parcel ID number, Listing Agent, Seller, and Listing Price > Click Calculate and Generate Certificate > Save PDF and upload to MLS

- Torrance County Tax Assessor

- Complete PDF and send to County Assessor, they are supposed to have it back to you by "the close of business of the business day following the day the request is received"

- Valencia County Tax Assessor

- Click Enter EagleWeb > Search for Property > Click on Property > Click Estimate Taxes (left side) > Enter List Price and click Print Tax Estimate > Save as PDF and upload to MLS